If You Bet on the Legal Marijuana Industry, You Can’t Bet in Casinos

At a convention this month in Las Vegas, regulators from the Financial Crimes Enforcement Network (FinCEN) announced that casinos, like banks, are subject to the same money laundering regulations that prevent doing business with the emerging legal marijuana industry.

The federal government considers all casinos, from Las Vegas’ and Atlantic City’s sprawling gambling meccas to small tribal and riverboat casinos, as financial institutions. We’ve reported previously how firms involved in the legal medical marijuana or recreational marijuana business in their state have run afoul of these money laundering regulations when they try to access banking services such as checking, credit, and loans.

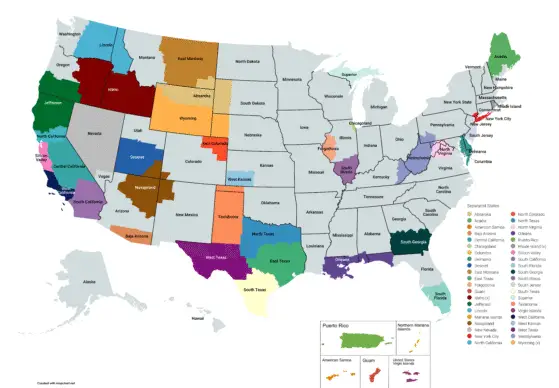

Those same laws apply to casinos, it seems, meaning that they must refuse bets from anyone associated with the marijuana industry, all the way from growers to processors to wholesalers to retailers. Even casinos where medical marijuana dispensaries are legal, like Oregon and Nevada, or where recreational pot shops are legal in Washington and Colorado, must ban bettors from the legal marijuana industry.

If a casino does accept bets from people in the marijuana industry, it must file a “suspicious activities” report with FinCEN, just as banks must do when processing any profits from the marijuana industry. These revelations show how the federal government is only now beginning to realize all of the ways in which state-legal marijuana conflicts with federal regulations.

FinCEN has issued a seven-page memorandum of guidance to casinos to watch for certain “red flags” that may indicate the use of a casino for marijuana money laundering, which include “depositing cash that smells like marijuana”. But with marijuana becoming more legal, more people are going to be carrying marijuana-scented cash; that doesn’t necessarily mean they’re in the marijuana business. As one money-laundering expert explained, “keeping track of this is very labor-intensive.”

FinCEN worries that casinos may become an alternative for marijuana businesses that cannot secure traditional banking services. One possibility is that a marijuana business could buy casino chips with the day’s cash, and then pay its employees with the casino chips that they could then redeem for cash. FinCEN already requires casinos to file a report if an individual buys or cashes at least $5,000 in a single day.

We can’t help but think that the solution to the problem of marijuana businesses laundering all their cash through casinos would be to allow marijuana businesses to have legitimate accounts with banks. The problem isn’t that we’ve legalized marijuana, it’s that we haven’t yet legalized marijuana enough.