State Tax Worker Allegedly Steals Medical Marijuana Dispensary Tax Payments

You’ve heard this story before. But this time, there’s a twist.

The federal government considers marijuana a Schedule I controlled substance.

Federal laws prevent financial institutions from laundering the proceeds of trafficking in Schedule I substances.

States have passed laws allowing the medical and recreational use of marijuana.

States have required that licensed sellers of marijuana pay state taxes.

Even though the substance they’re selling is federally illegal, licensed sellers also must pay their federal taxes.

Since the federal laws prevent these licensed sellers from opening bank accounts, these businesses are forced to pay their taxes with smelly duffel bags full of cash (which earns a 10 percent penalty) or money orders.

Enter Ed Medina, a Klamath Falls, Oregon, medical marijuana dispensary owner with the twist to our story.

State tax officials in Salem sent Medina a notice in February that his December tax payment hadn’t been received. Medina, however, had sent his December tax payment in as a money order on January 17 by certified mail. The state received it on January 20, according to USPS records.

Keith Mansur of the Oregon Cannabis Connection newspaper got in touch with Medina, who explained how “the department of revenue treated me as if I was the criminal” when he tried to explain that he had sent in his tax payment and he had the USPS receipts to prove his payment was sent and received, as well as Western Union documentation.

“After multiple contacts with the Department of Revenue explaining the situation, and getting no help whatsoever,” Medina told OCC, “I contact multiple law enforcement agencies, including the Postmaster General, Oregon Department of Justice, Klamath Falls Police, Oregon State Police, Marion County Sheriff’s department, and Salem Police. Each of those agencies claimed it wasn’t their jurisdiction. I got the run around for two days straight. I explained that I had copies of all of the documents, including copies of the signer for the certified mail, and copies of the forged and cashed money orders.”

Nevertheless, he persisted.

Medina finally got Salem Police Department to follow up on all the evidence he had forwarded. From their investigation, police determined that multiple money orders from Medina’s business had been stolen, forged, and cashed by the tax man himself!

Theodore Raymond Paulsen, a 55-year-old employee working in the State Department of Revenue, was arrested by police on June 14 on charges of first-degree theft, mail theft, first-degree official misconduct and possession of methamphetamine.

OCC Newspaper has copies of the evidence and notes that others may be arrested and more shops may have been victimized as Salem Police widen their investigation.

If Ed Medina had not kept meticulous records of his tax payments and used certified mail, I doubt that he would have gotten much help from police in solving this crime. Only through his dogged determination did police and state officials budge from their default position that those of us in the cannabis industry are not to be trusted.

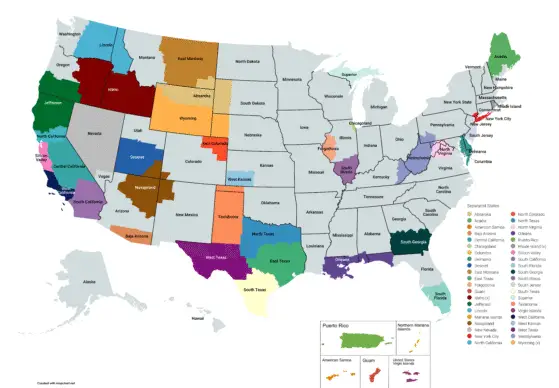

One can only imagine how many other business owners in how many other marijuana states are getting the shaft from the state when their tax payments turn up missing.

Of course, a great deal of the problem would be ameliorated if Congress would pass Rep. Ed Perlmutter’s Secure and Fair Enforcement Banking Act (SAFE Banking Act) so marijuana business owners like Medina can pay their taxes electronically, like every other legitimate business in America.

At least then a tweaker working in the state tax office would have to have some sort of hacking skills to steal marijuana money.